Welcome to the unofficial beginning of Summer!

It’s about three and a half weeks early; but since Labor Day weekend marks the unofficial end of Summer and it tends to run three week earlier than Summer actually ends, it works out.

The Observational Economist likes to check out strip malls, highways, and gas stations to measure economic strength on such occasions.

Strip malls tend to either be very busy or of middling neccessity on holiday weekends. The former is a sign of economic strength in the Fall and Winter and ditto for the latter in Spring and Summer.

Think about it. Thanksgiving, Christmas, MLK Day, and Presidents’ Day are all dotted with opportunities to buy and consume. Okay, maybe people aren’t going to the mall on MLK Day, but a lot of sports (particularly the NBA) schedule games on Monday afternoons in mid-January to cut their slice of what was designed to be a Day of Service.

Starting with St. Patrick’s Day and ending with Labor Day — it’s about celebrations and fun.

What’s this have to do with strip malls? The economy wants people to stick with the narrative. In gloomy and listless times, hanging out at a mall (strip or regular) is low-cost fun. A holiday stay-cation. You’re not going on a trip to the Jersey shore, the beach, or the mountains; you’re staying close to home and spending little.

The narrative prefers travel and fun over window shopping and ice cream.1

But the above is only a narrative from March to September for strip malls. October to February, an empty parking lot is a sign of doom and gloom.

(picture courtesy of Wikipedia)

So, the Observational Economist took a rather long trip home from his job at the casino turning a 22 minute commute into a 97 minute drive along Route 30 in western suburbs of Philadelphia.

Middling to barren parking lots on a bright sunny day. The major highways were neither clogged nor busy. The economy is fine.

When you bring up the economy and how strong it is, the Nihilists on the Right (when they aren’t controlling the White House) invariably point to gas prices.2

A few thoughts.

First, it’s important to understand how elastic gas prices are. They can shoot up pretty drastically depending on world events and oil industry catastrophes (e.g. an oil spill or a pipeline breakdown). And gas prices invariably ease going into Memorial Day Weekend to spur the lure of travel and Summer fun.

Second, it’s equally important to understand that outside of a vacation or weekend holiday trip, most Americans (about 85-90%) drive the same amount week in and week out. Your commute, your grocery store run, and your trip to a mosque, synagogue, or church add up to a set number of miles with little variance. So, it’s a case of static consumption. It’s worth noting that gas prices stay high when our consumption is the most static (January to March and September to mid-November).

Third, the net effect of the above two realities, elastic pricing and static consumption is that while rising gas price cost people a few more dollars, falling gas price only net them a few dollars. And as long as it doesn’t trend up for any length of time (and never fall back), the impact of fluctuating regular gas prices is largely inconsequential.

But as many recall from 2022, when gas prices went on a 4 month tear; inflation kicked in.

But what the Observational Economist noted back then was what was leading the fuel rise — diesel fuel prices. Trucks use diesel fuel. Trucks deliver the stuff to grocery stores, liquor stores, pharmacies, and strip malls. Energy costs (diesel fuel prices) were driving inflation.

Ever since gas and diesel prices abated in early May of 2022 (but not before the oil industry locked in massive profits), the Observational Economist began watching diesel prices rather than regular gas price.

Why?

Mostly because diesel fuel is much more inelastic than gas. And when one sees diesel fuel prices remain steady and regular gas prices behaving with more variance, the conclusion is obvious.

Big Oil engaged in price gouging and profiteering.

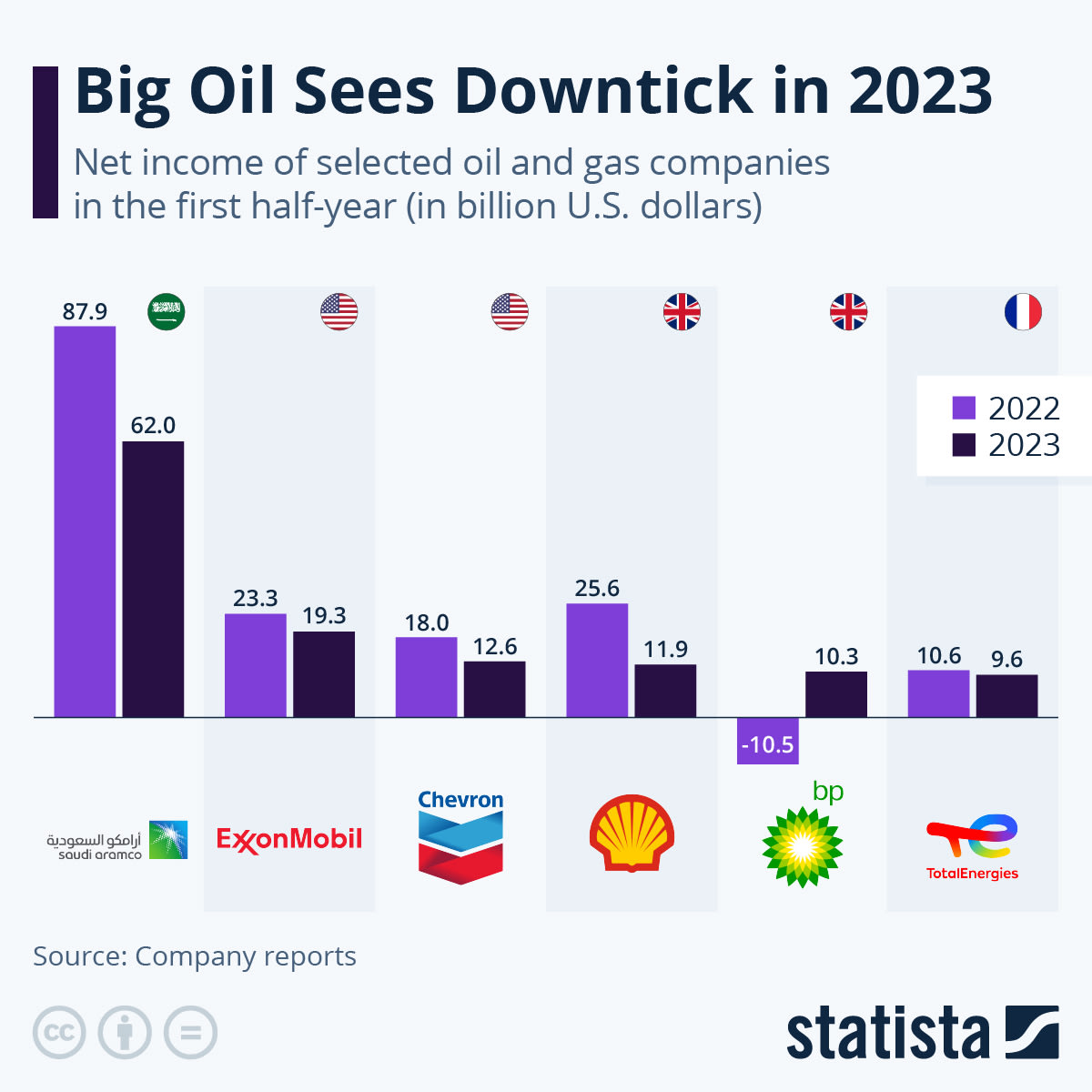

Here are the profits made by Big Oil in the Second Quarter of 2022.

These profits were made possible by Saudi Arabia not producing oil for nearly two years and lingering supply chain issues from the COVID pandemic in 2020 and 2021. (In April 2020 during the COVID lockdown, then-President Donald Trump made a deal with the Saudis to cut production fot two years. The deal was cut to protect Big Oil and keep oil prices stable.3)

The result was that the oil industry made over $200 billion in profits in 2022. They blamed the military invasion of Ukraine by Russia as the basis for increased prices beginning in February 2022. Reread the above paragraph for a dose of realism.

Their greed abated somewhat in 2023, when people like the Observational Economist pointed out the obvious that the war in Ukraine was merely an excuse to price gouge. Those poor oil companies only made $76 billion in profits last year.

Don’t think for a moment that the oil industry was alone in price gouging. Grocery stores, retailers, and big box stores have all made massive profits post COVID.

Blaming energy prices, supply chains, and Biden are just convenient stalking horses for corporate greed. And with journalism slowly catching onto this ruse, our monopolistic capitalist system will need to find a story to fool us with.

Observational Economist freebie: ice cream sales go up dramatically in bad times. Why? It’s a relatively low cost piece of happiness.

Both Republicans and Democrats always claim that the President has no control over gas prices when they control the White House.

The price per barrel in April 2020 was less than $0. It was artifically set at $10 a barrel because no one could deal with free.